Understanding your bill

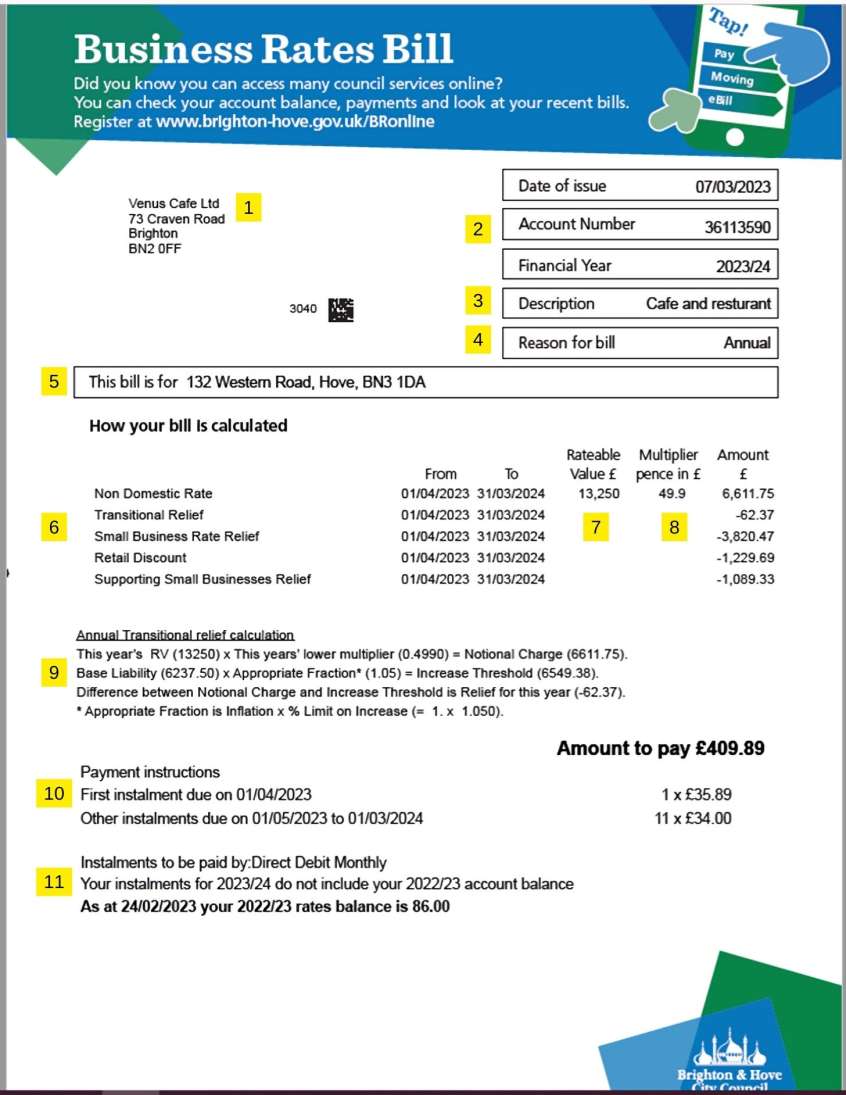

The image below shows an example of the business rates bill we'll send you each year, or if there are changes to your business rates account. A text version of the bill is also available below the image.

You can find detailed information about each part of the bill in the numbered sections below.

Text version of business rates bill

Business Rates Bill

Did you know you can access many council services online?

You can check your account balance, payments and look at your recent bills.

Register at www.brIghton-hove.gov.uk/BRonlIne

1. Venus Cafe Ltd

73 Craven Road

Brighton

BN2 OFF

Date of issue: 07/03/2023

2. Account number: 36113590

Financial year: 2023/24

3. Description: Cafe and restaurant

4. Reason for bill: Annual

5. This bill is for 132 Western Road, Hove, EIN3 1DA

How your bill is calculated

6.

| Rate and discount | From | To | 7. Rateable value £ | 8. Multiplier pence in £ | Amount £ |

|---|

| Non-domestic rate | 01/04/2023 | 31/03/2024 | 13,250 | 49.9 | 6,611.75 |

| Transitional relief | 01/04/2023 | 31/03/2024 | | | Minus 62.37 |

| Small business rate relief | 01/04/2023 | 31/03/2024 | | | Minus 3,820.47 |

| Retail discount | 01/04/2023 | 31/03/2024 | | | Minus 1,229.69 |

| Supporting small business relief | 01/04/2023 | 31/03/2024 | | | Minus 1,089.33 |

9. Annual transitional relief calculation

This year's RV (13250) x this year's lower multiplier (0.4990) = notional charge (6611.75).

Base liability (6237.50) x appropriate fraction (1.05) = increase threshold (6549.38).

Appropriate fraction is inflation x % limit on increase (= 1. x 1.050).

Difference between notional charge and increase threshold is relief for this year (-62.37).

Amount to pay £409.89

1 x £35.89 11 x E34.00

10. Payment instructions

First instalment due on 01/04/2023.

Other instalments due on 01/05/2023 to 01/03/2024.

11. Instalments to be paid by: Direct Debit monthly.

Your instalments for 2023/24 do not include your 2022/23 account balance.

As of 24/02/2023, your 2022/23 rates balance is 86.00.

Explanation of numbered areas of the business rates bill

1. This is the name of the person or company responsible for paying the bill, and the address the bill was sent to

2 to 5. This area includes a description of the business premises, the property you're being billed for, and your business rates account number. Include this number when contacting us so we can help you as quickly as possible. The reason for the bill being issued is shown here too.

6. This shows the dates you've been charged for and the amount for each period. Any discounts or reductions you get will also be shown here.

7. This is the rateable value of your business property.

8. This is the multiplier used with your rateable value to work out how much you need to pay in business rates.

9. If you're entitled to transitional relief, this shows how it's been worked out.

10. This shows the dates when your monthly payments are due and their amounts if you're paying your business rates in instalments.

11. Your chosen way of paying your business rates is shown here. The quickest and safest way is to pay by Direct Debit.